Metric Above 4.0% for 7th Straight Quarter

Originally posted by Jay Denton, despite moderation from the peaks of 2015, the national apartment market continued a rent-growth streak in the first quarter of 2016, according to early end-of-quarter apartment data from Axiometrics.

Axiometrics’ research showed:

- Annual effective rent growth of 4.1% in the first quarter of 2016 represented an 89-basis-point (bps) decrease from the robust 5.0% of one year earlier. The 1Q rate was also 52 bps lower than the 4.6 reported in the fourth quarter of 2015. Still, the latest figure was the second-highest first-quarter rate since before the Great Recession.

- Rent growth has been 4.0% or above for seven straight quarters. In only one other period in Axiometrics’ 21-year history (the fourth quarter of 2010 through the second quarter of 2012) has annual effective rent growth been at 4.0% or above for such a long period.

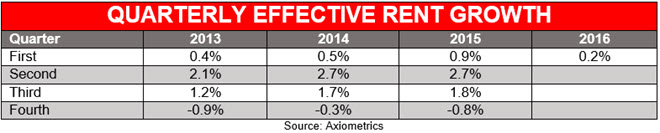

- Quarter-over-quarter effective rent growth was 0.2% in the first quarter. That rate was a 65-bps decrease from the 0.9% reported in 1Q15.

- Average national rent was $1,248 for the first quarter of 2016, a $49 increase from the average of $1,199 in the first quarter of 2015.

Even though rent growth is moderating, as Axiometrics has forecast, 4% growth still well outperforms the long-term average. The significant declines in primary metros such as the Bay Area, New York, Denver and Houston are being somewhat offset by robust gains in secondary markets like Sacramento, Orlando and Salt Lake City.

In other metrics:

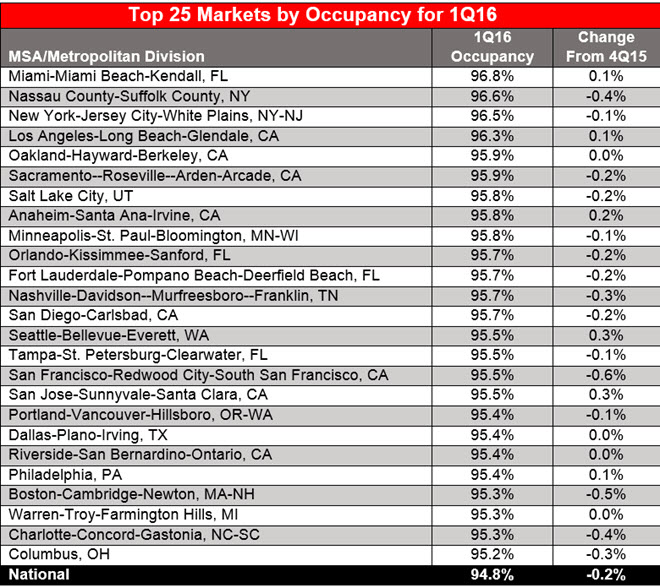

- Occupancy was 94.8% in the first quarter, tied for the highest 1Q rate since the 95.7% at the start of 2001. The 1Q16 rate was essentially the same as that of last year’s first quarter, but 16 bps lower than the 94.8% of 4Q15.

- Annual effective rent growth was positive in 49 of Axiometrics’ top 50 markets, based on number of units. Only Oklahoma City was negative, at -1.1%. Two metros, Sacramento and Portland, OR (12.0%) reported double-digit rent growth in the first quarter.

Sacramento Edges Portland as Top Rent-Growth Metro

Sacramento edged out Portland as the metro with the highest annual effective rent growth among Axiometrics’ top 50 markets by only 2 bps. Sacramento posted a rate of 10.68%, while Portland’s 10.66% wasn’t quite enough to continue its two-quarter reign at the top.

Oakland dropped to No. 3, while Seattle, Salt Lake City and Riverside emerged to round out the top six. California placed seven metros in the first-quarter top 25, while Florida placed five.

The top 25 Metropolitan Statistical Areas (MSA) or Metropolitan Divisions – among Axiometrics’ top 50 markets with the most apartments – reported the following results:

This article was originally posted by AxioMetrics and can be found HERE.